Have you wished to buy a laptop recently? Do you want to buy it on EMI but do not have a credit card? Do not worry. It is now possible to buy a laptop using a debit card. But keep in mind that not every debit card is eligible for EMI.

Some factors determine if your credit card is eligible, like which bank your debit card belongs to if you have made transactions in recent times, and that your saving account must have a higher MAB rule.

Following these things, you can easily purchase a laptop using a debit card. Your question: How to Buy a Laptop on EMI with Debit Card will be answered below.

Different Ways To Buy Laptop Without Credit Card:

- If you want to buy a laptop on EMI but don’t have a credit card, there are still several options available to you. Here are a few ways you can purchase a laptop on EMI without a credit card:

- Debit card EMI: Some banks offer debit card EMI options, allowing you to purchase a laptop on EMI using your debit card. Check with your bank to see if they offer this option.

- Personal loan: You can apply for a personal loan from a bank or financial institution to purchase a laptop. The loan can be repaid in monthly installments over a set period of time.

- EMI through retailer financing: Many retailers offer in-house financing options for customers, allowing you to purchase a laptop on EMI without a credit card. Check with the retailer you are interested in purchasing from to see if they offer this option.

- Buy now, pay later platforms: Some platforms such as LazyPay, Simpl, and ePayLater allow you to make purchases on EMI without a credit card. These platforms offer short-term credit options, allowing you to pay for the laptop over several months.

Before opting for any of these options, make sure to read the terms and conditions carefully and compare the interest rates and repayment options to choose the most suitable option for you.

Types Of EMI {What’s The Difference Between Regular EMI & No Cost EMI}

There are two types of EMI which are Regular EMI, and the other one is No cost EMI. The differences between Regular EMI & No cost EMI are:

Regular EMI:

- In the case of Regular EMI, your EMI amount consists of the interest component and the processing fees.

- This type of EMI is applied if you go more than six months in EMI duration.

- After that, regular installments are applied to both interest and principal each month to pay off the loan over a specified number of years.

No-cost EMI:

- When you opt for a no-cost EMI, no cost is added to the EMI amount, and your EMIs are interest-free.

- This type of EMI has only applied for 3 or 6 months EMI time duration.

- This scheme is best during the festive season when you need to shop in bulk while keeping your budget on record. This feature works in the case of exchange offers too.

How To Avail Of EMI In India?

The process of EMI is straightforward. Each bank contains a certain amount of purchase that has to be made. When the total purchase amount at a merchant exceeds a defined amount, the cardholder gets an option on the merchant’s platform to make the payment via Debit card EMI.

After selecting your EMI option, you need to enter your card details and validate them with an OTP. Your purchase will be made through an EMI after the OTP is entered. You cannot buy anything you want on EMI. All products cannot be bought on this offer.

To avail EMI option in India, you must ensure that the products you purchase cost more than rupees 8000. In case you have HDFC, ICICI, Federal, Axis, and Kotak Mahindra Debit cards, you can avail of the option of EMI on products that cost rupees 5000 or more. Anything below rupees 5000 or 8000 cannot be bought through EMI.

How To Buy Laptop On EMI With Debit Card?

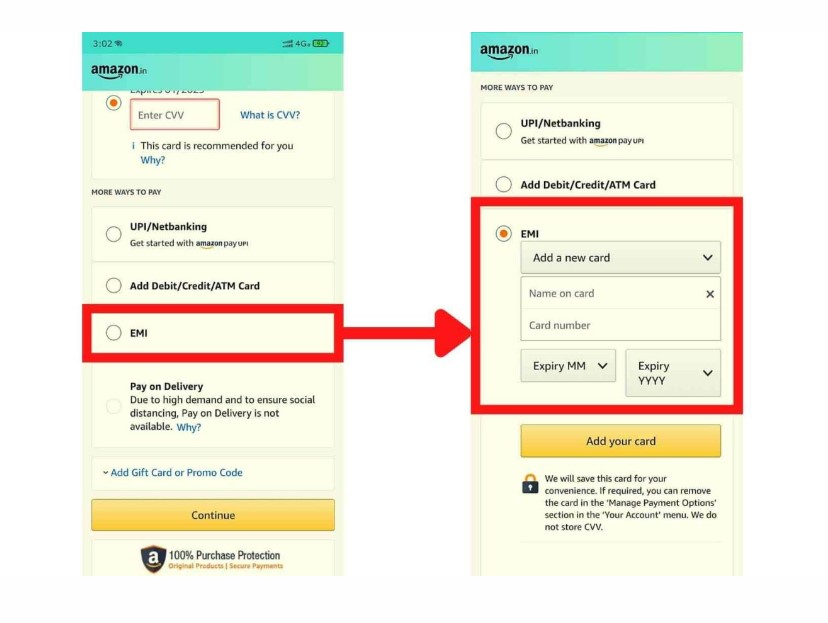

To buy a Laptop on EMI with a debit card, you need to follow the steps mentioned below:

- First, open the app or website of Amazon or Flipkart of your choice.

- Then, open and select the product that you are willing to buy.

- Finally, ensure that an EMI or No-cost EMI option is available in the product description.

- After that, tap on the Buy Now button.

- You will be guided to the next window, which will appear with the Payment Methods. You will be asked to choose the cards or other payment methods.

- Scroll down and select EMI, which is the second last option. Next, click on the EMI option.

- After this, you need to click on the Select EMI option and then click on Add a new card option.

- The processing time will take some time. However, if everything goes successfully, then you are eligible to buy your new laptop through EMI.

- Your card has been added successfully. You will then be taken to a page related to payment methods.

- Make sure you have chosen the EMI option and then click on the continue button.

- You will be guided to the next window, where you will be asked to choose the EMI option. Either select Pay in full or choose the different EMI options.

- Carefully choose the option you want. For example, if you want no-cost EMI, only choose 3 or 6 months EMI options. Else choose any option as your choice.

- After this, choose the option and click Choose EMI Plan.

- Carefully check all the options and then proceed further.

- Enter your address and place your order.

Mistakes You Should Avoid While Opting For EMI

One of the biggest mistakes people make while purchasing a laptop is that they choose the No cost EMI option but end up paying for the regular EMI. This is because they choose a period of 9 to 12 months.

One thing is to be noted the No Cost EMI is only available if you choose 3 to 6 months EMI options. Anything more than this time period is automatically applied as a regular EMI.

Hence, you can successfully purchase your new laptop on EMI using a debit card.

Do Follow These Steps As Well When Opting For An EMI:

- Not comparing interest rates: Make sure to compare interest rates and other charges from different lenders before choosing one.

- Ignoring the fine print: Always read the terms and conditions before opting for an EMI plan, as there may be hidden charges or penalties.

- Underestimating the total cost: Make sure to factor in all charges such as processing fees, interest rates, and other charges before choosing a plan.

- Not considering the repayment capacity: Make sure to choose a plan that is affordable and manageable in the long run.

- Not keeping track of the due dates: Missed or delayed payments can result in extra charges and impact your credit score.

- Not negotiating the terms: Don’t hesitate to negotiate the terms and conditions, interest rates, and other charges with the lender.

- Not having a backup plan: Make sure to have a backup plan for repayments in case of a financial emergency.

Choose Which Is The Best EMI Option For You:

No-cost EMI is the best EMI option of all, without any doubt. You do not need to pay anything extra at the end of 3 or 6 months. Since the period of EMI is less, the amount of installment is more.

On the other hand, if you choose regular EMI, you need to pay fewer monthly installments. At the end of the EMIs period, you must pay rupees 2000-3000 extra per the bank’s interest rate. Therefore try to choose the option with which you feel the most comfortable.

Frequently Asked Questions:

Yes, it is possible to give EMI with a debit card. No extra documentation or security deposit is needed. After your Savings or Current Account linked with your Debit Card is linked with the portal, your monthly payments will be deducted automatically.

First, you must choose your desired product at the merchant store and pay using the Equated Monthly Installment (EMI) option on your Debit Card. Once you have selected your EMI option, you need to enter your card details and validate them with an OTP. Your purchase will be made through an EMI after entering the OTP.

Yes, without any doubt, you can purchase a laptop on EMI. It is easier than ever to buy gadgets and consumer durables on EMI. Moreover, when you buy a laptop on EMI, you can purchase your dream machine at an affordable payment rate.

ICICI bank and Axis bank are the top two banks that offer EMI on debit cards. HDFC, Federal, and Kotak Mahindra Debit cards also provide the option of EMI.

To avail of Debit Card EMI, customers should pass the eligibility criteria set by their respective banks. If they fail, then they are not eligible for EMI. In addition, the minimum order amount on the Checkout should be ₹5000, and anything below rupees 5000 or 8000 cannot be bought through EMI.

You can call the bank’s customer service line or send an SMS to check your EMI eligibility. You can also check through the online process by navigating to the payments area of an e-commerce website’s checkout page. You will be qualified for EMI if you see it on your payment checkout page.

Conclusion:

Hence these were some steps on how to Buy a Laptop on EMI without Credit Card. Follow the steps mentioned above to avail yourself of EMI.

Try to go for no-cost EMI, as it is one of the best EMI options since when you choose no-cost EMI, you can convert the price of your product into interest-free EMIs, which will benefit you.

Hence your dream of now buying a laptop will be fulfilled by keeping your budget intact. So before choosing your option of EMI, please go through it and choose the one that will benefit you and with which you are comfortable.

I am a Chandan Tewatia and I am the founder of this blog cfindia.net. I have been in the industry for over 10 years and have worked with some of the biggest names in the business. I have a wealth of experience and knowledge to share, and my blog is a platform for me to do just that.